Cardinal Health is about to announce its dividend offering, which should make for 25 years of consecutive dividend growth. This soon-to-be Dividend Champion has many pluses and minuses as far as adding it to your portfolio is concerned.

Cardinal Health, Inc. is an integrated healthcare service and products company based in Dublin, Ohio. They specialize in the distribution of pharmaceuticals and medical products and manufacture surgical products and fluid management products. Being around for over 100 years and with 50,000 employees in 46 countries, they are currently #16 in the Fortune 500.

The company is split into two components – Medical and Pharmaceutical. The Medical segment includes medical gloves, feeding tubes, skin and wound management, surgical products, and numerous other categories. The Pharmaceutical segment provides one out of every six pharmaceutical products in the United States.

Start with Interactive Brokers

Performance

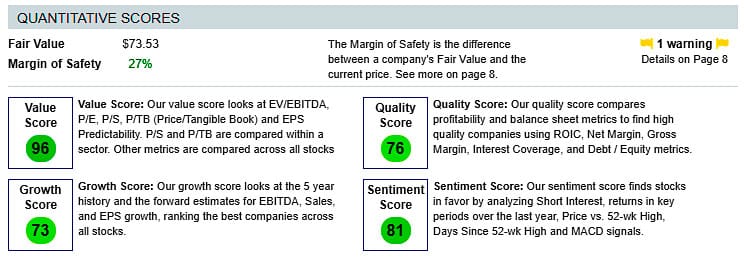

Over the past 10 years, the company’s performance was impressive in the initial five years and disappointing the most recent five years. This decline is the result of the market moving toward low-margin generics. One may decide that the company is unworthy of consideration, or, its P/E being about half that of the S&P 500, makes for an interesting opportunity. A glance at the company’s quantitative scores in Stock Rover’s Research Report indicates that the balance might be tipped toward the latter.

An examination of numerous analyst’s reports indicates that they appear to be fairly evenly divided between Hold and Strong Buy. While I do not base my decisions on such reports, it is interesting to see that there are two distinct camps of thought on this company.

Dividend

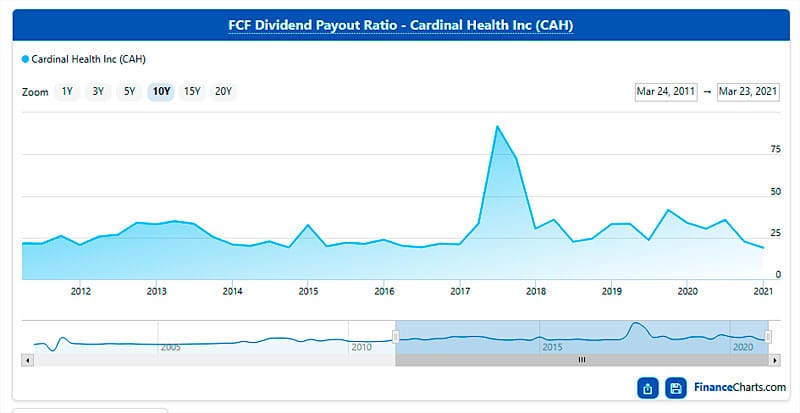

The current dividend yield is an appealing 3.4%, which compares favorably against their peers. Critically, their Free Cash Flow Dividend Coverage Ratio is, and consistently has been, well below 50%, so there is the confidence that the dividend will remain intact for years to come.

An Aside

In researching Cardinal Health I noticed that there were varying opinions on their actual dividend growth streak. These were not just random people in comments sections of articles offering their school of thought – these were knowledgeable authors.

For instance, Cory Cook, a SeekingAlpha author, wrote “The real number is 15 years of raises due to the dividend payouts between 2001 and 2005. June 2001 through March 2003 (8 quarters) dividend stayed at $0.018 per quarter. Again, in June 2003 through March 2005 (8 quarters), the dividend stayed at $0.022 per quarter.”

Perhaps this will be the subject of a future article, but the bottom line is that there are numerous definitions of what “X years of dividend increases” actually means. It is reasonable for an individual to look through a company’s past dividends and question if it supports that individual’s definition.

I will not get into the discussion at this point, but as an example of the interpretation, the Notes section of the spreadsheet states, “The initial goal was to identify companies that had increased their dividend in at least 25 consecutive years. But that definition was broadened to include additional companies that had paid higher dividends (without necessarily having increased the quarterly rate in every calendar year.”

A question I posed to Justin Law, maintainer of the CCC spreadsheet, concerned what “without necessarily having increased the quarterly rate in every calendar year” meant. Wouldn’t each company have increased the quarterly rate in every calendar year?

His response was, “This just means the list has some leniency for companies that might not increase their dividend every year. For example, if company XYZ increased its dividend in July 2019, but didn’t announce any increases in 2020, it would still pay out greater dividends in 2020 than 2019 due to the first two quarters being higher than the previous year. So the company would stay on the list through 2021, but if it kept the same dividend rate, it would then be removed for freezing its dividend.”

I acknowledge that different people can have different mindsets on this issue, have decided to save time and effort by simply following Justin’s research. For me, the crux of the matter is to find great companies with a long history of dividend increases, and almost any definition of that will point me in the right direction.

The Future

One item of concern consists of the company’s exposure to opioid litigation. While they have already agreed to a settlement to the tune of $5.6 billion, additional litigation could come their way.

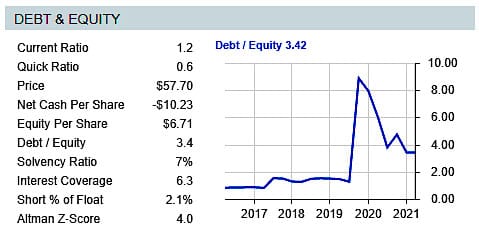

Another point of concern is the company’s debt situation. A Debt/Equity Ratio of 3.4 is something that can hold a company back. They paid down $1.4 billion of long-term debt in 2020, so the direction is positive, but it is something to monitor.

In March, Cardinal Health signed an agreement to sell its Cordis business in the first half of next year. While it is said to be doing this “to focus on its medical distribution and global medical products businesses,” it must be understood that they acquired Cordis in 2015 and are selling for a little more than half of the purchase price. Overpaying and failing to integrate are not signs of success.

Finishing Up

There appear to be many reasons for not adding Cardinal Health to one’s portfolio. That does not mean that there is not a case to be made in its favor. Each year, since 2014, the company has been able to increase its revenue. This is projected to continue for the next few years, and continued payback of their debt would be a big step in the right direction.

As the company is not currently valued as highly as its peers, and its P/E is nearly at a five-year low, this could be an opportunity to select an unloved company. At least, in the short term, the increased need for gloves, gowns, and masks should result in a reliable cash stream.

Finally, with an attractive dividend yield that appears to be safe, this could be a company that properly fits into one’s portfolio. It is a matter of balancing the pluses and negatives that leads to a proper decision.