You may not have heard of Church & Dwight, but you almost certainly have used Arm & Hammer Baking Soda, a perennial staple of the pantry. For the past 24 years, Church & Dwight has increased their dividend and is on the cusp of becoming a Dividend Champion.

Church & Dwight is a manufacturer of household products that has been around since 1846 when John Dwight and Austin Church began selling sodium bicarbonate (baking soda). Over time they have expanded by purchasing companies and products, like Pepsodent, Arrid, and Orajel. Their portfolio of products is within the fabric care, health and well-being, home care, and personal care categories.

Start with Interactive Brokers

While they live in a land of giants, like Proctor & Gamble, Unilever, and Kimberly Clark, the brands they own and continue to acquire are reliable cash cows.

In this past year of COVID, these staples have kept the company’s products within consumer homes. Even in difficult times, one still needs to clean their clothes, brush their teeth, and take their vitamin pills.

Many of the brands top their categories. With name recognition, regular purchase, and use, a reliable stream of revenue follows.

- #1 Baking Soda

- #1 Condom

- #1 Extreme Value Laundry Detergent

- #1 Pregnancy Kit

- #1 Depilatory

- #2 Battery Powered Toothbrush

- #1 Laundry Additive

- #1 Oral Care Pain Relief

- #1 Dry Shampoo

- #1 Adult & Kids Gummy

- #1 Power Water Flosser

- #1 Replacement Showerhead

- #1 Women’s Electric Hair Removal System

Company Segments

Church & Dwight is composed of three segments – Consumer Domestic, Consumer International, and Specialty Products.

Consumer Domestic

This primary segment of the company includes their twelve power brands, and is divided into household and personal care product groups. The former comprises about 55% of the sales and includes Arm & Hammer Baking Soda and other products derived from sodium bicarbonate, like refrigerator and carpet deodorizers, laundry detergent, and cat litter. Laundry detergent sales constitute the largest part of this group.

Church & Dwight has expanded their personal care group through the acquisition of products like antiperspirants, oral care, depilatories, reproductive health products, oral analgesics, nasal saline moisturizers, and dietary supplements. The group also includes the Trojan brand, battery-operated toothbrushes, water flossers, and showerheads.

Consumer International

This segment works in Australia, Canada, France, Germany, Mexico, and the United Kingdom, as well as over 130 global export markets around the world. Representing around 17% of total sales, all of the company’s products are included within this group.

Additionally, products unique to specific countries are made available, such as Sterimar nasal decongestant in France, Femfresh feminine hygiene products in the United Kingdom, Curash baby care products in Australia, and Rub-A535 topical analgesic in Canada.

Specialty Products

This segment focuses on sales to businesses and is divided into three areas – Animal and Food Production, Specialty Chemicals, and Specialty Cleaners. It accounts for approximately 7% of total sales.

Church & Dwight seems to be a Buffett-type company – generally boring products that are easy to understand and offer a stable cash flow. Acquiring dependable cash cows that offer excellent organic growth and an expected 10% growth over the next three years is a patient means to success.

Positioning

Above, I referred to Church & Dwight’s “Power Brands.” These are the brands within the Consumer Domestic segment that drive the company forward and are in one of the two top spots within their consumer staple categories. This group includes Arm & Hammer, Trojan, First Response, Nair, Spinbrush, OxiClean, Orajel, Vitafusion, Batiste, XTRA, WaterPik, Flawless and other household, and personal care products.

The exception to the strong growth of this group is the Trojan brand. According to the 2019 Annual Report, “condom usage has declined, as a result of a lower 18 to 24-year old population, alternate birth control options, less fear of HIV, less sex acts and, increased competition, all of which have contributed to lower demand.”

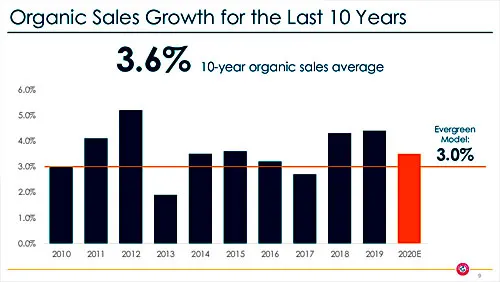

The strategy of acquiring Power Brands has worked well for CHD over the decades. Arm & Hammer, OxiClean, and XTRA grew 1.2% market share in 2018 in a segment dominated by the giant, Proctor & Gamble. Stable organic growth over the past 10 years has been about 3.6% in this competitive environment.

Dividend

At 1.1%, Church & Dwight’s dividend yield is not a point of attraction. This is a company one considers for the long haul, not one where the dividend itself is a convincing factor.

Its stock price over time, however, compensates for the small dividend. Over the past five years, its dividend adjusted return has bounced around as compared to the S&P 500, returning to slightly outperform it.

Their dividend growth rate over 1, 3, 5, and 10 year periods shows a slowdown, which may be a concern to the dividend-focused.

| DGR | DGR | DGR | DGR |

|---|---|---|---|

| 1-yr | 3-yr | 5-yr | 10-yr |

| 5.5 | 8.1 | 7.5 | 20 |

Payout Ratio

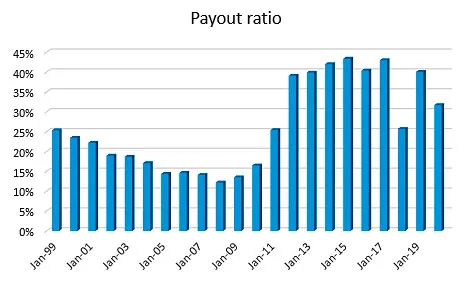

The safety of the dividend is an important element to consider. Church & Dwight’s payout ratio has remained consistently under the 45% mark, meaning that the dividend is not in jeopardy of being cut due to pressure through lack of earnings.

A Closer Look

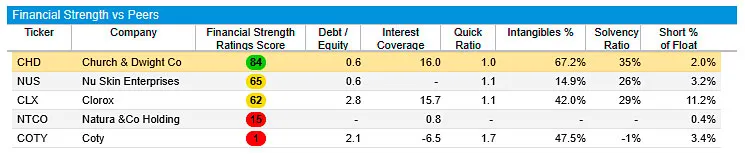

When a company builds itself on acquisitions, it needs to keep close tabs on its bottom line. Sales growth and debt are two areas of concern, and in these cases, it appears that Church & Dwight are in good shape.

Comparing three and five-year growth rates with its peers shows that the company is expanding well and gaining market share with its products. A look at its debt indicates that it is responsibly handling its acquisitions.

Finishing Up

In terms of valuation, the company has not been overlooked by investors. One can see by viewing the stock price chart that in September 2020 its value had moved to an unsustainable level, due to the necessity of its products in this COVID era. Even since its tumble, its P/E of 28 places it in a range that is above its peers.

If one is considering numerous small purchases over a long period of time, a high current valuation may not be as important as to those who seek to make a single large purchase.

Church & Dwight appears to be well placed to continue to offer a dividend far into the future, and is a welcome addition to the Dividend Champions.