Dividend investing is not just for those who wish to actively research and select companies. Some mutual funds are focused on dividend companies and offer diversification to the investor’s portfolio.

I have been a fan of mutual funds since I began investing. Funds with bundles of companies can offer diversification to one’s portfolio, helping to smooth some of the swings that individual companies offer. This diversification reduces risk and gives the investor a better chance to sleep well at night.

The problem with some mutual funds is that they are accompanied by rather high expense ratios. These are costs imposed by the fund manager to pay for the actions taken to maintain the fund. Each tenth of a percent fee is one-tenth of a percent taken from one’s portfolio. I will examine low expense ratio index funds in a moment but for now, will address actively managed funds.

Start with Interactive Brokers

Actively Managed Funds

We tend to think of those who study stocks and select them for a living as having a special ability beyond our grasp. Certainly, some are in that category (Warren Buffett, Peter Lynch, etc.), but for the most part, this is not the case, and demonstrably so. Fund managers are as vulnerable to human frailties as everyone else, and the additional pressure of quarterly reports to fund owners can lead to miscalculations.

I decided to look for an example of a successful fund manager by Googling “2018 mutual fund manager best”. I intended to see who had been highly regarded a couple of years ago and follow the results of the decisions they had made over that time.

One of the first offerings was 4 Mutual Fund Managers Who Can Help You Beat the Market, an article by James Glassman, a contributing columnist for Kiplinger Personal Finance. Mr. Glassman listed seven actively managed funds he considered his personal favorites that had mostly beaten the S&P 500 over the previous ten years.

Seven Funds to Beat the Index

| Fund | Symbol | Expense Ratio |

|---|---|---|

| Dodge & Cox Stock | DODGX | 0.52% |

| Fidelity Contrafund | FCNTX | 0.68% |

| Mairs & Power Growth | MPGFX | 0.66% |

| Nicholas Fund | NICSX | 0.72% |

| Oakmark Fund | OAKMX | 0.89% |

| Parnassus Fund | PARNX | 0.86% |

| Parnassus Endeavor | PARWX | 0.95% |

It is one thing to cherry-pick funds that have beaten the index over the past ten years, which can be helpful when making a selection. It is another thing to see how those selections panned out over subsequent years.

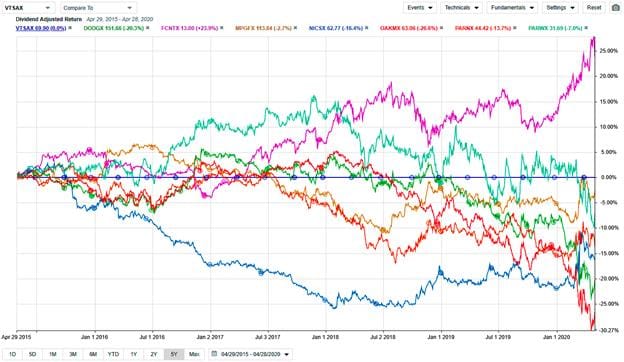

Stock Rover allowed me a simple means of charting the performance of these funds over the past two years, and to no surprise, the results were less than overwhelming.

Graph courtesy Stock Rover

The chart shows that more than half of Mr. Glassman’s 2018 favorite funds were compared negatively to the market (VTSAX, Vanguard’s Total Stock Market Index Fund is used here as a proxy) in the two years following the article. Two of his picks lost over 15% as of this writing. Owning all seven of these funds would have seen the investor down 4.1% when compared to the market proxy.

Pushing this group back five years from today shows an even more dramatic loss to the index.

Graph courtesy Stock Rover

A five-year timeframe gives us an opportunity to view performance over both bull and bear markets. Some funds will outperform in one or the other situation, but the long-term dividend investor will probably encounter both during the time of their investment.

In this case, the Fidelity Contrafund did exceptionally well when compared to the market but the other six lagged, a couple by more than 20%. Fidelity Contrafund has done very well because Amazon and Facebook are its largest holdings and both companies have soared over the past several years.

Bad news sometimes comes in pairs and in this situation, the other bad news is that these funds have expense ratios higher than index funds. An expense ratio is the percentage of assets that are charged by the company that administers the fund to cover expenses, including the salary of the person managing the fund.

The expense ratio for each fund is listed in the table above, with an average of 0.75%. This means that one is paying a fund manager to make bad decisions on their behalf. And the even worse news is that the expense ratios in the table were drawn from the original article and may not be what the company is charging today. For instance, over the past two years, the Fidelity Contrafund expense ratio has increased from 0.68% to 0.85%.

Index Funds

Index funds have considerably lower expense ratios. This is because the stock selections are not made by a fund manager, but are the result of a company’s inclusion within a specific grouping. There is no decision to be made, a company is either in the index or it is not. If a company is in the S&P 500 then it is in the S&P 500 index fund – if it is not, then it is not. The only decision the fund manager needs to make is how to most efficiently convert incoming and outgoing cash to and from the fund to adjust the fund with the correct weighting of stocks.

Vanguard invented the index fund. The creation of their first index fund in 1976 brought the ire of the industry upon them as somehow being “un-American”. Vanguard now manages $5.1 trillion in assets, so apparently, it was a successful idea.

The first company I worked for that offered a 401(k) used Vanguard, so I have invested in their index funds over many years. Today just about every company that manages funds has index funds that compare favorably to Vanguard – Fidelity even offers no-minimum, no-expense ratio index funds, which sounds very enticing.

But as this is a website with an interest in dividends, I wondered how index funds that base their stock selections on dividend-paying companies compare with the market. Vanguard has three dividend funds that deal with U.S. companies and they are listed below.

Vanguard U.S. Dividend Index Funds

| Fund | Symbol | Expense Ratio |

|---|---|---|

| Dividend Appreciation Index Fund Admiral Shares | VDADX | 0.08% |

| High Dividend Yield Index Fund Admiral Shares | VHYAX | 0.08% |

| Dividend Growth Fund | VDIGX | 0.22% |

I have owned the VDADX fund for quite some time (expense ratio of 0.08%) and consider it to be one of my most important retirement investments. VDIGX is not an index fund (note the higher expense ratio) but I included it because it concentrates on dividend growth.

The most obvious element in this graph is the pink line moving down to show a loss of more than 10%. This represents the movement of the Vanguard High Dividend Yield Index Fund.

There are numerous articles critical of dividend investing due to concerns of dividend cuts. These concerns are legitimate. After all, without these concerns, it would make sense to simply select the highest dividend companies and cash in when their dividends are distributed.

However, high dividend stocks tend to teeter on the edge of sustainability and when expected dividends do not come to pass the company is severely punished. The fund has only been active a little over one year so perhaps over time the high-risk aspect of the fund will prove more worthy of consideration.

On the other hand, VDADX and VDIGX have performed quite well when compared to the market. The presence of dividends with their quarterly returns to investors assists with the company’s price. Not attempting to play on high dividends and focusing on safe dividend investing helps to smooth the path during difficult times.

Finishing Up

Many companies offer low-expense ratio dividend index funds that may be helpful to the investor who wishes to be involved in dividend investing but does not want to make individual stock selections. Combined with total market or S&P 500 index funds, these conservative index funds can offer the basis of a strong portfolio.

For those who wish to select individual stocks, these funds are an excellent means of adding a degree of diversity and risk management to their portfolio. I have always relied primarily on index funds for the majority of my portfolio, which has given me the diversity I need. This allows me to select individual stocks irrespective of sector or market capitalization because my diversification is already intact.

Dividend index funds can be an important foundation adding diversity and value to any portfolio.